RM2 accurately forecasts USD/CHF to help a large Real Estate Firm secure lower interest rates

The Challenge

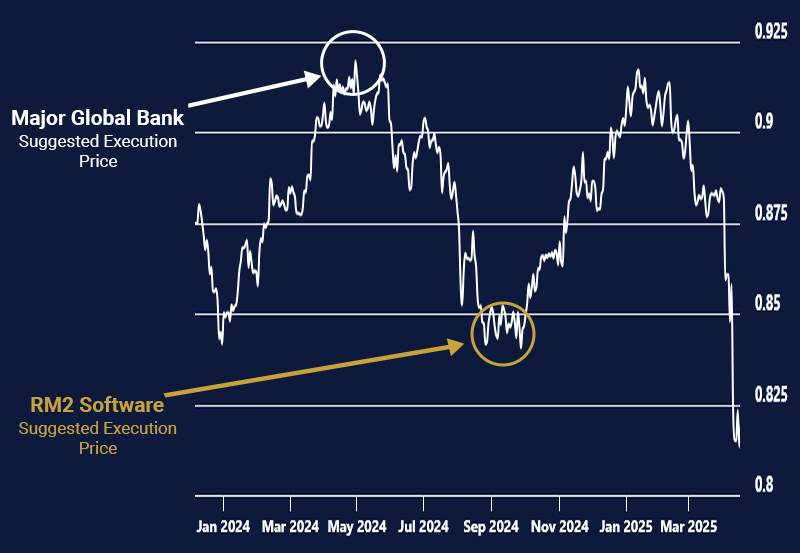

A large real estate firm sought a $100M loan, aiming to capitalize on lower interest rates in Switzerland compared to the U.S. While initially working with a major international bank, the firm grew skeptical of the bank’s FX guidance and reached out to RM2 Tech for independent pricing intelligence. With such a large transaction, USD/CHF timing and execution were critical to optimizing loan performance and minimizing risk

The Solution

RM2’s predictive software provided accurate currency forecasting and execution support:

- RM2 correctly forecasted a decline in USD/CHF from 0.94 to 0.84, aligning with the firm’s ideal execution window.

- This insight created a $12.47 million buffer, delivering 10.41% downside protection.

- The client also avoided two potential $2M margin calls, adding $4 million in additional savings.

- Total financial impact: $16.47 million in downside protection and savings through precise FX timing and risk management.